Addy AI

About Addy AI

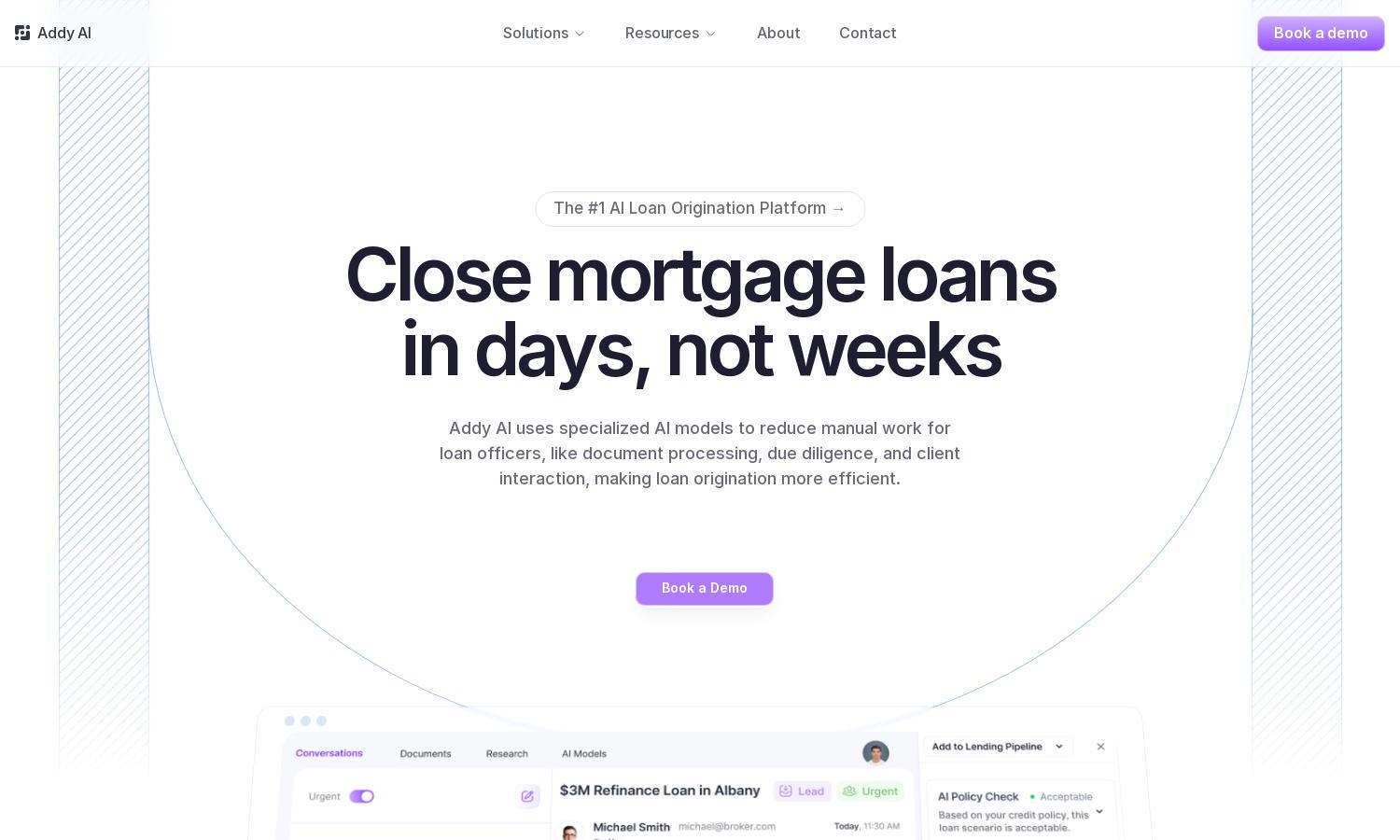

Addy AI revolutionizes mortgage lending by automating the loan origination process, allowing lenders to save valuable time and improve efficiency. Users can train AI models to handle tasks like document processing and client follow-ups. With Addy AI, lenders can close loans faster and enhance their workflow seamlessly.

Addy AI offers flexible pricing plans to cater to diverse lending needs, ensuring value at every tier. Each subscription unlocks different features, enhancing loan processing speed and efficiency. Users benefit from special discounts for annual subscriptions, making it a cost-effective solution for mortgage lenders.

Addy AI's user interface is designed for maximum efficiency, featuring a seamless layout that facilitates easy navigation. Unique user-friendly elements streamline the loan origination process, allowing users to access essential tools quickly. The intuitive design enhances user experience, making it simple for lenders to manage tasks effectively.

How Addy AI works

Users of Addy AI begin by onboarding the platform, where they can easily set up custom AI models tailored to their specific loan origination needs. After onboarding, users navigate a user-friendly interface to access essential features, such as document processing and automated client interactions, enabling seamless integration with existing systems and enhancing overall efficiency in closing loans.

Key Features for Addy AI

Custom AI Model Training

Addy AI’s custom AI model training enables mortgage lenders to automate tasks specific to their lending process. By personalizing AI to fit their requirements, users can enhance operational efficiency and reduce manual workload, ensuring faster loan processing and improved client satisfaction.

Instant Loan Assessments

The instant loan assessment feature of Addy AI checks loans against credit policies in real-time. This ensures that borrowers are evaluated swiftly and accurately, with immediate suggestions for improving eligibility. This innovative feature streamlines decision-making and enhances the overall lending experience, optimizing workflow for lenders.

Seamless CRM Integration

Addy AI's seamless CRM integration allows mortgage lenders to synchronize loan data effortlessly. By connecting with existing CRM systems, users can enhance their workflow efficiency, maintain accurate records, and optimize client follow-ups, ensuring timely communication and improved customer satisfaction throughout the loan origination process.