finbots.ai

About finbots.ai

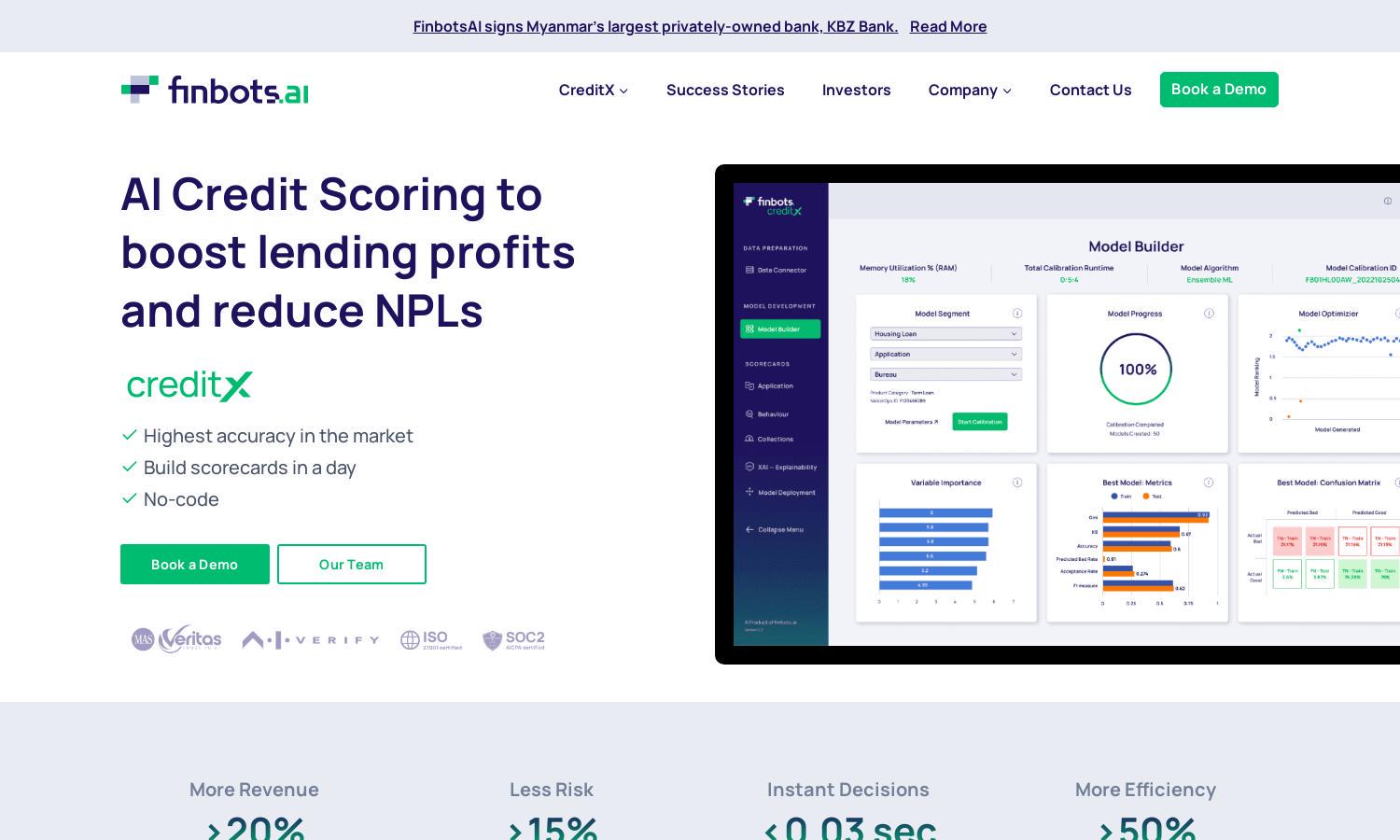

finbots.ai provides an innovative AI-driven credit risk management platform targeting lenders seeking efficiency and profitability. Leveraging proprietary technology, it enables users to create and deploy custom scorecards quickly, making accurate lending decisions while enhancing operational efficiency and reducing non-performing loans in financial institutions.

finbots.ai offers flexible pricing plans for its creditX solution, providing significant value across tiers. Discover affordable options catering to startups and established banks, with a 30% discount for the first six months. Upgrading offers enhanced features and improved efficiency, boosting profitability in lending operations.

The user interface of finbots.ai is designed for seamless navigation, allowing easy access to core functionalities. With a clean layout and intuitive design, users can effortlessly build custom scorecards and make real-time lending decisions. finbots.ai emphasizes user experience, enhancing operational efficiency and effectiveness.

How finbots.ai works

Users of finbots.ai begin by onboarding through a straightforward process, where they connect their internal and external data to the platform. They can then utilize the robust AI algorithms to build and validate custom credit scorecards in less than a day. The platform allows users to monitor performance and make data-driven decisions with real-time insights, boosting efficiency and enhancing risk management.

Key Features for finbots.ai

Rapid Custom Scorecard Creation

With rapid custom scorecard creation, finbots.ai allows users to build and deploy tailored credit scoring models in under a day. This unique capability streamlines the lending process, enabling businesses to make prompt, informed decisions that improve efficiency and reduce risks in credit assessments.

AI-Driven Decision Making

finbots.ai utilizes advanced AI technology for instant decision-making, empowering lenders to assess credit risks in real-time. This feature significantly enhances operational efficiency, reduces processing time, and improves overall lending accuracy, making finbots.ai an essential tool for financial institutions seeking competitive advantage.

Automated Data Validation

Automated data validation is a standout feature of finbots.ai, ensuring accurate data treatment and standardization. By automating the validation process, finbots.ai enhances the reliability of credit assessments, minimizing errors and enabling lenders to make more precise and informed lending decisions seamlessly.